Ethereum’s Defi TVL Dominates by 61% Increasing 10% During the Last Week, Cross-Chain Bridge Value Jumps 16.2% in 30 Days

The value locked in decentralized finance (defi) has climbed higher since the low it saw on January 23 dropping $10 billion below the $200 billion mark. Today the TVL is 13.60% higher as the value locked has increased a great deal during the last few days.

The protocol Uniswap’s TVL jumped 9.44% during the last seven days, Balancer increased by 9.25%, and this week Makerdao’s TVL swelled by 9.10%. Furthermore, smart contract platforms, in terms of market capitalization have increased their overall value to $674 billion up 8.3% in the last 24 hours.

The top smart contract platform token ethereum (ETH) has seen its value swell by 18.5% in the last seven days. Binance coin (BNB) jumped 8.8% this week, and cardano’s (ADA) value increased by 9.3%.

At the same time, solana (SOL), polkadot (DOT), terra (LUNA), and avalanche (AVAX) saw double-digit weekly gains. SOL climbed the highest this past week, jumping 25.6% against the U.S. dollar.

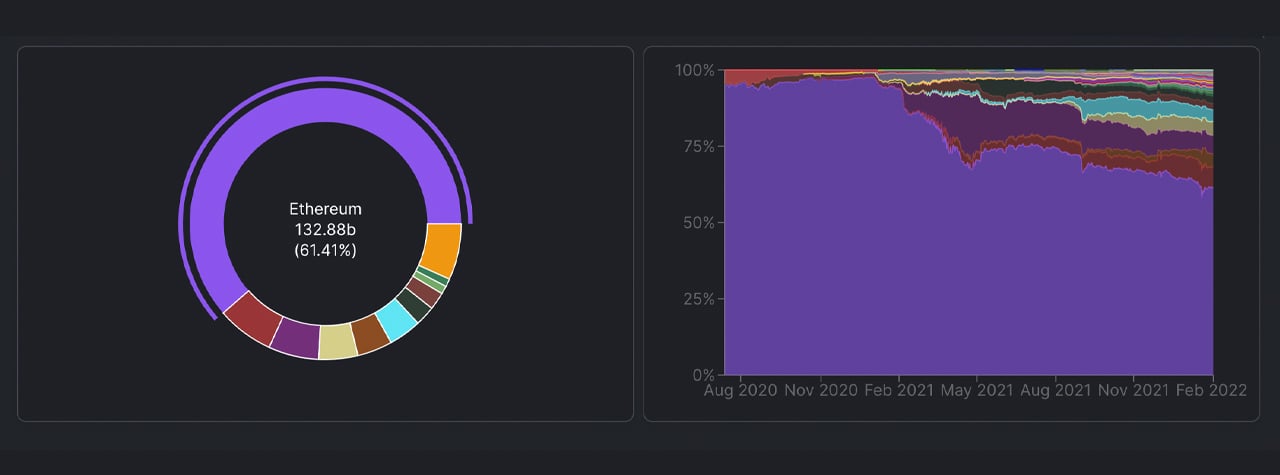

In terms of defi TVL per blockchain, Ethereum still rules the roost with 516 defi protocols and $135.78 total value locked today. ETH’s TVL represents 61.41% of the entire $216.49 billion locked in defi. The second-largest defi chain is Terra with the network’s 17 defi apps commanding $14.67 billion in value today.

While Ethereum saw a seven-day change by increasing its TVL by 10%, Terra’s defi TVL jumped 7.49%. Avalanche (AVAX) saw one of the largest jumps this week in the top ten TVLs by chain with a 19.38% increase to $10.08 billion.

Cross-chain bridge TVLs have increased during the last month by 16.2% and today, there’s $25.11 billion locked across various bridges. While Polygon’s bridges lead the pack with a $5.59 billion TVL, Avalanche has $5.53 billion locked on Saturday.

Wrapped ethereum (WETH), ethereum (ETH), and USDC are the most leveraged crypto assets on cross-chain bridges this weekend.

Disclaimer: The information provided on this page

does not constitute investment advice, financial

advice, trading advice, or any other sort of advice

and it should not be treated as such. This content is

the opinion of a third party and this site does not

recommend that any specific cryptocurrency should

be bought, sold, or held, or that any crypto

investment should be made. The Crypto market is

high-risk, with high-risk and unproven projects.

Readers should do their own research and consult a

professional financial advisor before making any

investment decisions.

INVESTMENTS DISCLAIMER

Although the material contained in this website was prepared based on information from public and private sources that KavaWire.com believes to be reliable, no representation, warranty or undertaking, stated or implied, is given as to the accuracy of the information contained herein, and KavaWire.com expressly disclaims any liability for the accuracy and completeness of the information contained in this website.