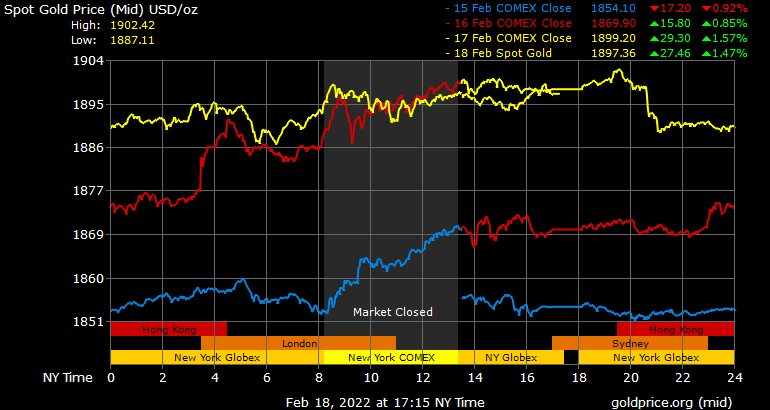

In contrast with the performance of the stock market and cryptocurrency market during the past week, gold’s value increased by 3.85%. As of February 19, fine gold was trading at $1,897.36 per ounce, up from $1,826.92 on February 10. A significant increase in demand has been witnessed today for top gold-backed crypto coins as well as premiums above the spot market price of gold.

Gold Shines During Economic Uncertainty

The world’s economy has been shaky and many are blaming the turmoil between Russia and Ukraine, and the possibility of war. This has caused equities markets to drop this past week and by the closing bell on Friday, all three of the top indexes remained in the red. Nasdaq closed at -168, the Dow Jones closed at -232, and NYSE was down -99 at the end of the day on Friday as well. Furthermore, cryptocurrency markets followed suit as billions of dollars have left the crypto economy as it dropped below the $2 trillion range last week to $1.88 trillion.

Today, the crypto economy has lost 3.1% in USD value during the last 24 hours and bitcoin (BTC) has dropped below the $40K price zone. In contrast to equities and cryptocurrencies, the precious metal gold has done well this week, gathering 3.85% in USD value over the last seven days. At the time of writing one Troy ounce of .999 fine gold is changing hands just below the $1,900 range at $1,897.36 per ounce. An ounce of .999 fine silver has also increased in value since January 28. On that day, an ounce of silver traded for $22.47 per ounce, and today it’s changing hands for $23.94.

Tokenized Gold Market Caps Swell, Specific Gold Tokens See Premiums Over Spot

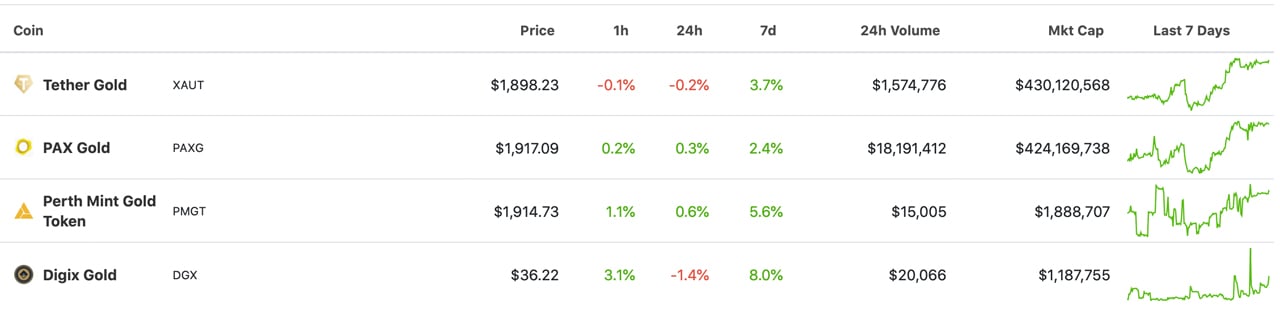

While precious metals have seen markets move northbound in value, demand for tokenized gold crypto coins has increased. Between tether gold (XAUT), pax gold (PAXG), perth mint gold token (PMGT), and digix gold (DGX), all four tokenized gold coin market caps have increased in value between 2.4% and 8% over the last week. XAUT and PAXG are the two largest gold-backed crypto coins in terms of market valuation. XAUT has an overall market cap of $430 million and PAXG’s valuation is $424 million.

Meanwhile, all of them have been fluctuating between the spot market value of gold and a decent premium as well. For instance, at the time of writing, pax gold (PAXG) is changing hands for $1,917.09 per coin which is 1.039% above spot market prices. Perth mint gold token (PMGT) is also trading for higher prices than the spot market value of an ounce of physical gold. Currently, PMGT’s premium is 0.915% above the current $1,897.36 per ounce recorded on February 19.

25 days ago Bitcoin.com News reported on the enormous growth of tether gold (XAUT) and pax gold (PAXG) and since then the valuations have grown larger. On January 25, XAUT’s market cap was $410 million and over $20 million in value has been added. PAXG’s market cap was $332.7 million and $92 million in USD value has been added over the last 25 days. XAUT’s market valuation has swelled by close to 20,000% in two years while PAXG has seen a 16,000% increase during that time frame.

Similar to stablecoins, crypto economy participants have found value in gold-backed digital currencies and the trend seems to be a mainstay in the industry. Like their physical counterparts, digital gold tokens can help someone hedge against market downturns. With the current premiums, arbitrage opportunities can happen as well, just like they do within fiat-pegged stablecoin markets.

Disclaimer: The information provided on this page

does not constitute investment advice, financial

advice, trading advice, or any other sort of advice

and it should not be treated as such. This content is

the opinion of a third party and this site does not

recommend that any specific cryptocurrency should

be bought, sold, or held, or that any crypto

investment should be made. The Crypto market is

high-risk, with high-risk and unproven projects.

Readers should do their own research and consult a

professional financial advisor before making any

investment decisions.

INVESTMENTS DISCLAIMER

Although the material contained in this website was prepared based on information from public and private sources that KavaWire.com believes to be reliable, no representation, warranty or undertaking, stated or implied, is given as to the accuracy of the information contained herein, and KavaWire.com expressly disclaims any liability for the accuracy and completeness of the information contained in this website.